Company Structure

Who regulates LCH?

LCH Group Holdings Limited – the parent company

LCH Limited - the UK entity

- Recognised as a central counterparty and supervised by the Bank of England under the Financial Services and Markets Act 2000.

- Recognised as a Third Country central counterparty to offer services and activities in the European Union in accordance with the European Markets Infrastructure Regulation (EMIR). This includes Norway, following amendment of the EEA Agreement to incorporate EMIR.

- Registered as a Derivatives Clearing Organization with the Commodity Futures Trading Commission (CFTC), USA.

- Recognised as a Foreign Central Counterparty by the Swiss Financial Market Supervisory Authority (FINMA).

- Recognised as a Foreign Central Counterparty by the Banco de México (BdM)

- Recognised as a Clearing Agency by the Ontario Securities Commission (OSC), Canada to offer SwapClear, ForexClear and RepoClear clearing services to Ontario-resident clearing members. The SwapClear service is designated as systemically important by the Bank of Canada.

- Recognised as a Clearing House by Autorité des Marchés Financiers (AMF Québec) to offer SwapClear, RepoClear and ForexClear clearing services to Québec-resident clearing members.

- Holds an Australian CS Facility Licence granted by the Minister under the Corporations Act 2001 to provide in Australia the SwapClear service.

- Recognised as a Recognised Clearing House by the Monetary Authority of Singapore to provide the SwapClear and ForexClear services in Singapore.

- Licensed by the Japanese Financial Services Agency to provide the SwapClear service (excluding Yen products) and non-deliverable FX forwards in Japan.

- Granted by the Hong Kong Securities and Futures Commission ATS-CCP authorizations for SwapClear and ForexClear to provide clearing services in Hong Kong, and designated as a CCP in respect of SwapClear for the purposes of the Hong Kong mandatory clearing obligation for certain OTC derivative transactions.

- Oversight by other market regulators and central banks in jurisdictions in which business is carried out.

LCH SA – the Continental European entity

- Authorised as a central counterparty to offer services and activities in the European Union in accordance with the European Markets Infrastructure Regulation (EMIR).

- Regulated as a credit institution and central counterparty by its National Competent Authorities (NCAs) : l'Autorité des marchés financiers (AMF), l'Autorité de Contrôle Prudentiel et de Résolution (ACPR), and Banque de France (BDF).

- Designated as a Securities and Settlement System by its National Competent Authorities (NCAs) to the European Commission.

- Registered as a Derivatives Clearing Organization (DCO) with the US Commodity Futures Trading Commission (CFTC), for its CDS business.

- Registered as a clearing agency with the US Securities and Exchange Commission (SEC).

- Recognised as a foreign central counterparty by the Swiss Financial Market Supervisory Authority (FINMA).

- Authorised to continue offering clearing services to its UK members by the AMF and Bank of England (BoE) – LCH SA to enter the Temporary Recognition Regime (TRR) for 3 years as of the effective Brexit date

- Authorised by the Japan Financial Services Agency (JFSA) as a foreign clearing organization operation in France to engage in the business equivalent to financial instruments obligation

- Exempted from the requirement to be recognized as a Clearing Agency/House by both Ontario Securities Commission (OSC) and Autorité des marchés financiers Québec (AMF Québec)

- Oversight by other regulators in jurisdictions in which business is carried out.

QCCP Status

QCCP Status of LCH can be found here

Markets Served

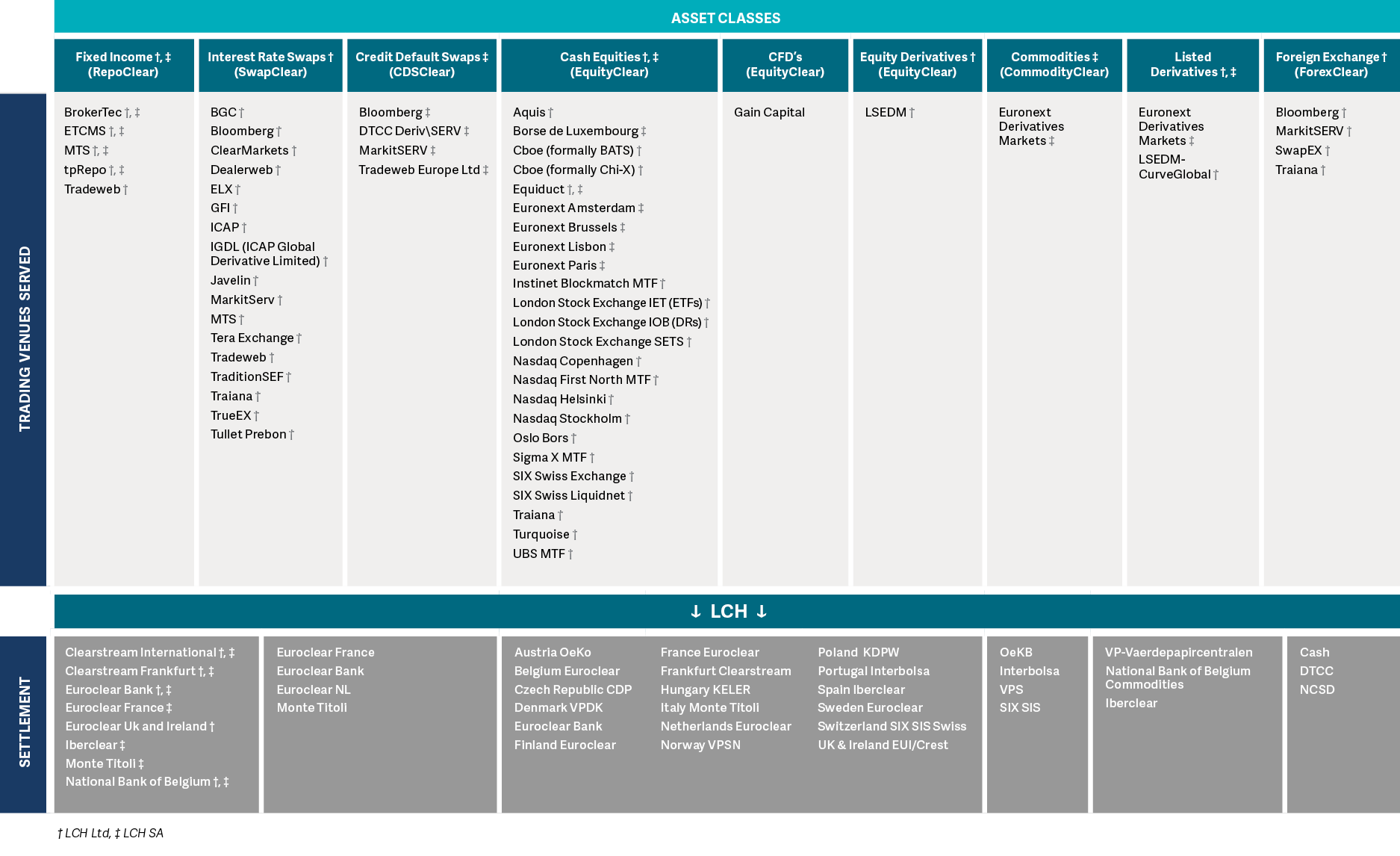

LCH provides clearing services in six distinct asset classes: Commodities, Credit Default Swaps, Equities, Fixed Income, Foreign Exchange, Interest Rate Swaps and Listed Derivatives.

LCH is connected to dozens of execution venues, affirmation platforms and post-trade settlement providers, offering our Clearing Members and their clients the broadest range of trading locations and settlement options available in the market today.

Below you can find a comprehensive list of the trading venues and settlement providers which LCH partners with in each asset class.